Published on September 18, 2018 (widewalls.ch), by Angie Kordic

The online auction house ARTIANA, a well-known platform based in Dubai, will now expand its activities and offer a one-of-a-kind service on the market right now – their Fine Art Finance service.

Announced just ahead of their November 2018 sale of South Asian art, it is an art finance advisory division that will specialize in financing solution to both buyers in their auctions and those who can borrow against blue-chip Indian artworks. By financing their purchases at Artiana auctions, clients can take advantage of opportunity buys and schedule a delayed or installment payment on their acquisitions based on their cash flows. By leveraging existing artworks, our clients optimize the use and enjoyment of their collection, while unlocking equity and allowing further portfolio diversification.

We talk to ARTIANA’s founder Lavesh Jagasia about the importance of such service being available within the field of Indian art and its market, as well as what it could mean for all sides of the sales.

The ARTIANA Fine Art Finance

Widewalls: What brought the creation of the ARTIANA Fine Art Finance on? How did it come to be?

Lavesh Jagasia: ARTIANA Fine Art Finance will assist us in increasing our clients and broadening the collector base of Indian art. Being a part of the Indian art sphere for the last 3 decades, I have experienced the effects that lack of liquidity has on this market just as it does on any other asset class. There are many times that works are sold in auctions for attractive prices, and end buyers are unable to take advantage of these situations as they would have not planned such purchases. With other collectors already holding significant portions of their net-worth in Indian art and unable to sell it quickly or leverage it when required, it limits their investments in this sphere due to the illiquid nature of this asset class.

By introducing our FlexiPay ‘Bid Now Pay Later’ facility in our auctions and offering bespoke finance solutions for blue-chip Indian art, we will address these issues resulting in deeper penetration of the market.

Widewalls: How does the service you’d be providing differ between the buyers and those who borrow against blue-chip Indian artworks?

LJ: The buyers on the ARTIANA auction platform have multiple benefits as compared to those offering external art assets as collateral. All items offered in our auctions are eligible for deferred or installment payments under our FlexiPay ‘Bid Now Pay Later’ scheme as long as the clients have been pre-approved for this facility. ARTIANA buyers have access to a higher Loan-To-Value (LTV) ratio of up to 80% of our lower estimate value as compared with up to 60% of our appraised value of all external art assets. The arrangement fee of 2% of the advance amount is also waived from them.

Charges for evaluation, storage and the conservator’s inspection report are currently complimentary for all clients, but maybe applicable to external clients in the future.

Widewalls: What is the process like for those who wish to approach ARTIANA in order to use this service? What can they expect and what is expected of them?

LJ: For prospective bidders in our auctions, the process is quite simple. All they need to do is select between the deferred or installment payments offered in our ‘Bid Now Pay Later’ plans, agree to the Terms and Conditions thereof and get a pre-approval prior to the commencement of the auction, confirming their eligibility for this facility. If their bids are successful, then they can then choose to either pay as usual or opt for their pre-approved FlexiPay facility.

The clients who want to propose external art assets as collateral, will have to first send us the image and details of the artworks. After our preliminary requirements of the artwork, such as artist and ownership are met, then an appraisal and condition check will be carried out, subsequent to which, the evaluation, LTV and terms are discussed with them ahead of the next steps.

In both cases, the artworks are stored in our art storage facility till all amounts due against them are cleared.

Making an Impact on the Indian Art Market

Widewalls: Why Indian art? Is it exclusively Indian art?

LJ: Yes, currently we are offering this facility only on blue-chip Indian artworks. This is a market that we have in-depth knowledge of, and is our core area of focus even in our auctions. Our expertise in this domain enables us to effectively manage the risks, and have quick turnaround times in structuring bespoke solutions for our clients.

Widewalls: The ARTIANA Fine Art Finance is the first service/product of its kind out there. What are the advantages you offer, as a company already in the bespoke business, compared to other sources of financing?

LJ: That is correct, currently there is no service/product available that offers specialized financing solutions for Indian art. Our advances offer flexibility and a variable term. Unlocking equity and receiving liquidity without cumbersome documentation and credit approval process. There is no personal liability, the collateralized artworks are the sole guarantee towards the advance (non-recourse).

Widewalls: How do you see this service having an impact on the art market and the way business is being done in sales?

LJ: The availability of flexible payments in our auctions will allow buyers to make purchases and plan their payments, no longer having to wait till the entire amount is available before placing a bid or making an opportunity purchase when a work is going for an attractive price at auction.

With the clients who will use this service for external art assets, they could use this facility to unlock equity and diversify their collection, for short-term funding and bridge finance to acquire works while awaiting sale transactions on their existing ones.

The availability of liquidity against only certain blue-chip artworks will also segregate the market identifying investment-grade art from the rest.

All of this will positively impact the Indian art market and increase overall sales of the artworks that qualify for this service.

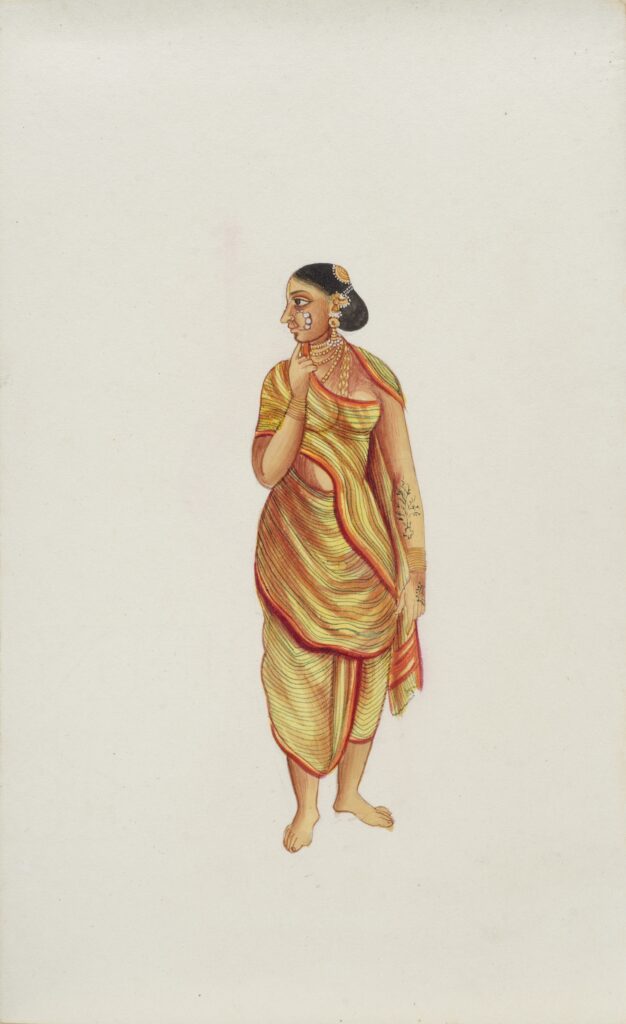

Company Painting – Brahmin with a water pot- Tanjore, c.1850 – gouache on paper – 18 x 11.1 cm (painting) – Lot 3

Company Painting – Brahmin with a water pot- Tanjore, c.1850 – gouache on paper – 18 x 11.1 cm (painting) – Lot 3

Sakti Burman – ‘Musicians Playing for Krishna’ – 2015 – Oil on canvas – 63.8 x 51.2 in. (162 x 130 cm.) – Lot 41

Sakti Burman – ‘Musicians Playing for Krishna’ – 2015 – Oil on canvas – 63.8 x 51.2 in. (162 x 130 cm.) – Lot 41

Maqbool Fida Husain – ‘Arjun and Sudarshan Chakra’ – circa 1980s – Acrylic on canvas – 40 x 60 in. (102 x 153 cm.) – Lot 21

Maqbool Fida Husain – ‘Arjun and Sudarshan Chakra’ – circa 1980s – Acrylic on canvas – 40 x 60 in. (102 x 153 cm.) – Lot 21