What is ARTIANA Fine Art Finance?

Artiana Fine Art Finance is our art finance, advisory division. Leveraging upon the strength of our auction house platform, we specialize in financing solutions that cater to both – buyers in our auctions as well as others who can borrow against blue-chip Indian artworks.

What services does ARTIANA Fine Art Finance provide?

We provide finance solutions to consignors and buyers at our auctions and arrange advances secured against Indian fine art at competitive interest rates. Our bespoke finance solutions provide financing for fresh acquisitions or existing collections.

Why finance or borrow against art?

By financing their purchases at Artiana auctions, clients can take advantage of opportunity buys and schedule a delayed or installment payment on their acquisitions based on their cash flows. By leveraging existing artworks, our clients optimize the use and enjoyment of their collection, while unlocking equity and allowing further portfolio diversification.

What type of art does ARTIANA Fine Art Finance accept as collateral?

We will consider individual artworks and collections of blue-chip Indian fine art as collateral. Artworks must be freely marketable and produced by prominent artists with an existing track record in the secondary market.

What is the artwork evaluation process?

We are an auction house, and offer advisory services on a highly confidential basis to evaluate artworks. The individual artwork or collection will be estimated by us as if they are being proposed for auction, and the advance against this item / s will typically be 50% of the lower estimate value offered by us. We will also require an independent inspection by a conservator.

What Loan-To-Value (LTV) does ARTIANA Fine Art Finance offer against the artworks?

We will typically advance up to 80% of the lower estimate value of artworks purchased at our auctions or up to 60% of the appraised value of the proposed external art collateral.

What are the advance sizes that ARTIANA Fine Art Finance offer?

We arrange advances starting at USD 50,000 and can assist in securing advances of substantially larger amounts.

How long does the disbursal take?

The approval depends on the location of the artworks and the clients’ art ownership structure. However, our domain expertise and large, liquid balance sheets of our financiers allows us to complete the process more quickly than traditional operators.

Do our clients retain possession of their art?

No, we require that the artwork be held as collateral in our art storage facility till the advance has been fully paid back to our financier.

Will the artworks be insured during the term they are held as collateral in storage?

Throughout the term that the artworks are held as collateral, they will be insured at double of the advance amount, to cover the full value of the art asset. The policy will be assigned to us for distributing the amounts as stipulated, between the client and financier. The insurance covers the items right from the time of collection, during storage until the final handover.

Who owns the artworks during the term they are held as collateral in storage?

The artworks remain the clients’ property during the entire storage period.

What are the advantages of Artiana’s fine art finance compared to a traditional bank loan?

Our advances offer flexibility and variable tenors up to 24 months with a no-charge early exit option. Unlocking equity and receiving liquidity without cumbersome documentation and credit approval process. There is no personal liability, the collateralized artworks are the sole guarantee towards the advance (nonrecourse).

What are the early exit options before the expiry of the agreed tenor?

Clients can request an early exit before the expiry of the agreed tenor by giving a 30 days notice without any exit charges being payable. Any advance service charges collected in such cases will be non-refundable. For exercising in rare and unlikely situations, we reserve the right of an early exit option on behalf of our financiers by giving a 90 days notice to the client.

What are the charges and costs for the service and advance?

Artiana Fine Art Finance will charge an arrangement fee of 2% of the advance amounts arranged against external art assets, this fee is waived for finance arranged against purchases made in our auctions. Depending on the value, tenor and terms of the advance the charges are calculated at typically 15 % p.a., payable quarterly in advance for fixed maturity payments, and at a flat rate of 10 % p.a. for monthly installment payments. The charges are set at the start of the facility and fixed for the entire tenor. There are no additional costs for evaluation and storage, insurance cover is procured for double the advance amount to typically cover the full value of the asset and billed at actuals to the client.

Our art finance advisory division provides finance to clients buying and consigning at our auctions. We also provide bespoke financing solutions against blue-chip Indian art assets that can be custodized by us in our art storage facility.

Published on September 18, 2018 (widewalls.ch), by Angie Kordic

Announced just ahead of their November 2018 sale of South Asian art, it is an art finance advisory division that will specialize in financing solution to both buyers in their auctions and those who can borrow against blue-chip Indian artworks. By financing their purchases at Artiana auctions, clients can take advantage of opportunity buys and schedule a delayed or installment payment on their acquisitions based on their cash flows. By leveraging existing artworks, our clients optimize the use and enjoyment of their collection, while unlocking equity and allowing further portfolio diversification.

We talk to ARTIANA’s founder Lavesh Jagasia about the importance of such service being available within the field of Indian art and its market, as well as what it could mean for all sides of the sales.

Widewalls: What brought the creation of the ARTIANA Fine Art Finance on? How did it come to be?

Lavesh Jagasia: ARTIANA Fine Art Finance will assist us in increasing our clients and broadening the collector base of Indian art. Being a part of the Indian art sphere for the last 3 decades, I have experienced the effects that lack of liquidity has on this market just as it does on any other asset class. There are many times that works are sold in auctions for attractive prices, and end buyers are unable to take advantage of these situations as they would have not planned such purchases. With other collectors already holding significant portions of their net-worth in Indian art and unable to sell it quickly or leverage it when required, it limits their investments in this sphere due to the illiquid nature of this asset class.

By introducing our FlexiPay ‘Bid Now Pay Later’ facility in our auctions and offering bespoke finance solutions for blue-chip Indian art, we will address these issues resulting in deeper penetration of the market.

Widewalls: How does the service you’d be providing differ between the buyers and those who borrow against blue-chip Indian artworks?

LJ: The buyers on the ARTIANA auction platform have multiple benefits as compared to those offering external art assets as collateral. All items offered in our auctions are eligible for deferred or installment payments under our FlexiPay ‘Bid Now Pay Later’ scheme as long as the clients have been pre-approved for this facility. ARTIANA buyers have access to a higher Loan-To-Value (LTV) ratio of up to 80% of our lower estimate value as compared with up to 60% of our appraised value of all external art assets. The arrangement fee of 2% of the advance amount is also waived from them.

Charges for evaluation, storage and the conservator’s inspection report are currently complimentary for all clients, but maybe applicable to external clients in the future.

Widewalls: What is the process like for those who wish to approach ARTIANA in order to use this service? What can they expect and what is expected of them?

LJ: For prospective bidders in our auctions, the process is quite simple. All they need to do is select between the deferred or installment payments offered in our ‘Bid Now Pay Later’ plans, agree to the Terms and Conditions thereof and get a pre-approval prior to the commencement of the auction, confirming their eligibility for this facility. If their bids are successful, then they can then choose to either pay as usual or opt for their pre-approved FlexiPay facility.

The clients who want to propose external art assets as collateral, will have to first send us the image and details of the artworks. After our preliminary requirements of the artwork, such as artist and ownership are met, then an appraisal and condition check will be carried out, subsequent to which, the evaluation, LTV and terms are discussed with them ahead of the next steps.

In both cases, the artworks are stored in our art storage facility till all amounts due against them are cleared.

Widewalls: Why Indian art? Is it exclusively Indian art?

LJ: Yes, currently we are offering this facility only on blue-chip Indian artworks. This is a market that we have in-depth knowledge of, and is our core area of focus even in our auctions. Our expertise in this domain enables us to effectively manage the risks, and have quick turnaround times in structuring bespoke solutions for our clients.

Widewalls: The ARTIANA Fine Art Finance is the first service/product of its kind out there. What are the advantages you offer, as a company already in the bespoke business, compared to other sources of financing?

LJ: That is correct, currently there is no service/product available that offers specialized financing solutions for Indian art. Our advances offer flexibility and a variable term. Unlocking equity and receiving liquidity without cumbersome documentation and credit approval process. There is no personal liability, the collateralized artworks are the sole guarantee towards the advance (non-recourse).

Widewalls: How do you see this service having an impact on the art market and the way business is being done in sales?

LJ: The availability of flexible payments in our auctions will allow buyers to make purchases and plan their payments, no longer having to wait till the entire amount is available before placing a bid or making an opportunity purchase when a work is going for an attractive price at auction.

With the clients who will use this service for external art assets, they could use this facility to unlock equity and diversify their collection, for short-term funding and bridge finance to acquire works while awaiting sale transactions on their existing ones.

The availability of liquidity against only certain blue-chip artworks will also segregate the market identifying investment-grade art from the rest.

All of this will positively impact the Indian art market and increase overall sales of the artworks that qualify for this service.

Published on September 16, 2018 (moneycontrol.com), by Tasmayee Laha Roy

All the exquisite Indian art work that adorns your walls can now get you a loan.

Dubai-based online art auction platform, Artiana has started a one-of-its-kind service -Artiana Fine Art Finance. Leveraging upon the strength of the auction house platform, Artiana is all set to provide financing solutions that cater to both buyers in auctions as well as others who can borrow against blue-chip Indian artworks.

While there are platforms like Levart, Sotheby’s Financial Services and others that provide loan against artwork what is special about Artiana is their services are dedicated towards blue-chip Indian artwork.

Clients having artwork that qualifies as collateral for this facility and can arrange the physical delivery of these pieces to Artiana’s storage facility in Dubai, can use this service. Interestingly, the equity released against the artwork can be used for any purpose and there are no restrictions on the deployment of these funds.

What exactly does Artiana Fine Art Service do? They provide finance solutions to consignors and buyers at our auctions and arrange advances secured against Indian fine art at competitive interest rates. “Our bespoke finance solutions provide financing for fresh acquisitions or existing collections,” said Lavesh Jagasia, Founder of Artiana.

Art work has been an investment option for a lot of people for years now but unlike other commodities like gold or real estate art is not easy to sell. At least not as quickly as other investment options. This is the gap Artiana wants to bridge.

“There are times that works are sold in auctions for attractive prices, and end buyers are unable to take advantage of these situations as they would have not planned such purchases. With other collectors already holding significant portions of their net-worth in Indian art, and unable to sell it quickly or leverage it when required limiting their investments in this sphere due to the illiquid nature of this asset class,” Jagasia said.

With bespoke finance solutions for blue-chip Indian art, Artiana wants to address these in the art market.

As for the amount of finance provided, while there is no upper limit the minimum advance size is $50,000 which could be against one work or a collection of works.

But what Loan-To-Value (LTV) does Artiana Fine Art Finance offer against the artworks? “We will typically advance up to 80 percent of the lower estimate value of artworks purchased at our auctions or up to 60 percent of the appraised value of the proposed external art collateral,” Jagasia said.

Explaining why the company came up with financial solutions against blue-chip Indian artwork only, Jagasia said, “We currently focus on Indian art in our auctions, hence to be able to accurately estimate and guide our clients and financiers we prefer to stay within this domain. Secondly, there is no other such product/service available for Indian art making the facility a welcome addition to the Indian art sphere having a pent-up demand.”

As for the kind of artwork that can be used for availing the service, Artiana will consider individual artworks and collections of blue-chip Indian fine art as collateral. Artworks must be freely marketable and produced by prominent artists with an existing track record in the secondary market.

The artworks are evaluated by both Artiana and also independently inspected by a conservator.

For securing the transactions throughout the term that the artworks are held as collateral they will be insured at double of the advance amount, to cover the full value of the art asset. The insurance covers the items right from the time of collection, during storage until the final handover.

As for Artiana’s interest in the lending process, Artiana Fine Art Finance will charge an arrangement fee of 2 percent of the advance amounts arranged against external art assets, this fee is waived for finance arranged against purchases made in their auctions. Depending on the value, tenor and terms of the advance the charges are calculated at typically 15 percent per annum payable quarterly in advance for fixed maturity payments, and at a flat rate of 10 percent per annum for monthly installment payments.

Published: May 15, 2018 (moneycontrol.com), by Tasmayee Laha Roy

Around 60 works that were on the block at the Artiana South Asian Art auction were sold fetching close to Rs 11.1 crore.

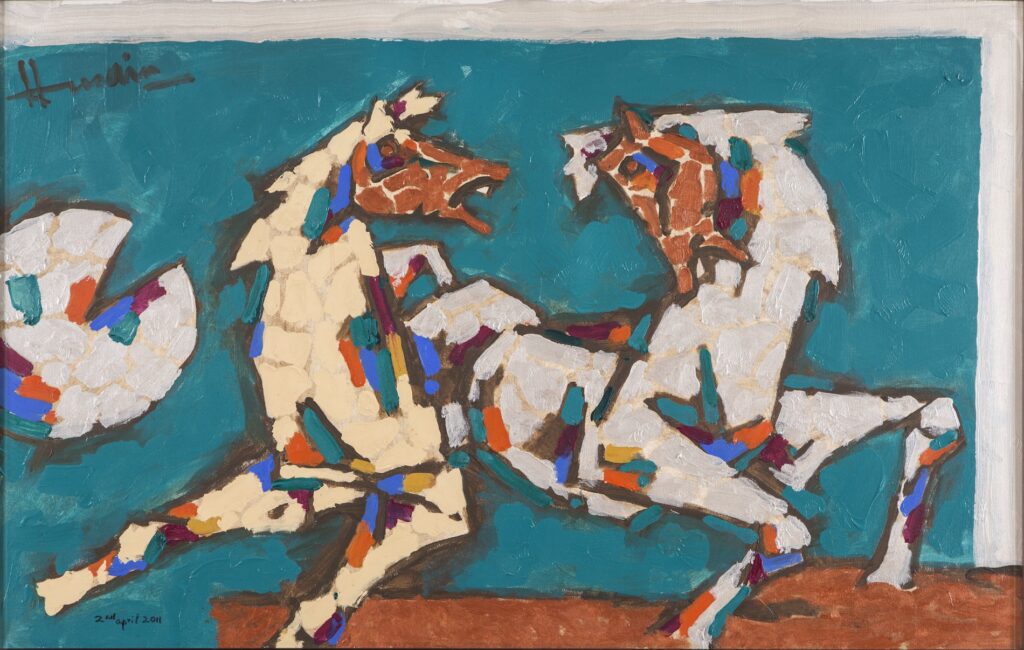

Various works by Indian artists have been on the global art connoisseur’s map for some time now and the late MF Husain‘s paintings have been a favorite whenever they have gone under the hammer.

Dubai-based online art auction house Artiana has concluded its first white glove (100% sold) sale, thanks to Husain. The artworks that fetched the top two bids came from the Indian modern artist.

Around 60 works that were on the block at the Artiana South Asian Art auction were sold fetching close to Rs 11.1 crore. The works were estimated to rake in around Rs 10 crore.

Not surprisingly, one-third of the auction proceeds came from Husain’s works. “At an Asian auction if Husain is on the block there is a very slim chance of any other artwork making it to the top buys,” said Lavesh Jagasia, founder at Artiana, UAE’s first home-grown auction house for art and luxury collectibles.

“The top two artworks were sold to two UAE residents where Husain and is very popular. We had a hectic four-day bidding session where we saw a lot of new buyers taking interest in Indian artworks. India and UAE are where most of the buyers came from,” added Jagasia.

Artists that made it to the top-10 included Husain’s new to the market Trinity of Mother Teresa that fetched Rs 2.2 crore followed by another of his untitled painting that fetched Rs 1.5 crore. Other entries on the list included Krishen Khanna’s Thou Sayest So, Sayed Haider Raza’s Dhayan and Zarina Hashmi’s Home is a Foreign Place that collected Rs 95 lakh, Rs 81.5 lakh and Rs 40.8 lakh, respectively.

Ram Kumar, Jamil Naqsh, Francis Newton Souza, K. Laxma Goud, Bhupen Khakhar were other artists who saw maximum bids. Their lots made close to Rs 1.8 crore.

With a No Buyer’s Premium Policy where buyers do not have to pay a commission for the artwork purchased, Artiana has streamlined the online auction process offering clients important elements of traditional auction house services such as expertise, gallery viewings, and printed catalogues.

Published: May 4, 2018 (moneycontrol.com), by Tasmayee Laha Roy

This May, those who admire MF Husain and his works have something to look forward to. After selling his ‘The Last Supper’ at $ 1.1 million against a lower estimate of $700,000, Dubai-based online art auction platform Artiana is again putting up another 55 Indian artworks on the block at their South Asian Art – Classical, Modern and Contemporary Online Auction between May 10 and May 14.

The May auction will feature new-to-market works by MF Husain with ‘Trinity of Mother Teresa’ being the cover lot and another painted on the day of the India and Sri Lanka Cricket World Cup final match — two horses depicting the two teams as stallions of the cricket world. The auction that would have 90% Indian artwork also includes ‘Thou Sayest So’ by Krishen Khanna, ‘Shanti Bindu’ by SH Raza and an impressive bronze sculpture of Vishnu among other rare works by Bhupen Khakhar, Ram Kumar and SH Raza.

While ‘Trinity of Mother Teresa’ from 1989, a suitable vintage Husain artwork, has a lower estimate of $350,000, Krishen Khanna’s work has one of $100,000. The auction has a novelty factor too. Artiana has got rid of the buyer’s premium, facilitating bidders to invest more in the bid. “By getting rid of the buyer’s premium, we make sure that a bidder invests his entire budget on the artifact and not in paying service charges,” said Lavesh Jagasia, founder at Artiana, UAE’s first home-grown auction house for art and luxury collectibles.

According to Jagasia, his audience is divided into three halves — Indian bidders, bidders from UAE and those from the rest of the world.

After completing five successful auctions, Artiana’s future auctions are planned for art from the Middle East which will comprise works by Emirati artists including other surrounding countries and diaspora artists from this region, a sale of rugs and carpets, which will offer a range of hand-woven Oriental rugs and carpets, including textiles such as European paisley and Indian jamawar shawls.

Published: May 8, 2018 (Widewalls), by Angie Kordic

For four days this May, between the 10th and the 14th to be precise, there will be yet another splendid auction of South Asian Art hosted by the ARTIANA auction house from Dubai. A total of 60 lots will be featured in this online sale, including classical, modern and contemporary paintings and sculptures from the Indian subcontinent.

For four days this May, between the 10th and the 14th to be precise, there will be yet another splendid auction of South Asian Art hosted by the ARTIANA auction house from Dubai. A total of 60 lots will be featured in this online sale, including classical, modern and contemporary paintings and sculptures from the Indian subcontinent.

Among the highlights, we have an impressive bronze figure of Vishnu, a collection of 20 Company Paintings, a seminal 1989 painting by M.F. Husain, Trinity of Mother Teresa and Krishen Khanna’s marvelous Thou Sayest So from 1980.

Let us also not forget the leading figures of South Asian contemporary art, such as S.H. Raza, Bhupen Khakhar, F.N. Souza, Jamil Naqsh, Jogen Chowdhury… And who better to discuss this exciting sale than Lavesh Jagasia, ARTIANA’s founder and an expert on South Asian art with as many as three decades of experience in the field.

With Mr. Jagasia, we also discuss the introduction of VAT in the United Arab Emirates, its effect on the art market, the current state of affairs in that aspect, and of course, ARTIANA’s future plans. Have a read below!

How did ARTIANA’s last auction do and what are the highlights of the upcoming ‘South Asian Art’ sale?

Our last auction was very successful with a sell-through rate of 96% and total sales at 128% of the lower estimate value. Our cover lot, the seminal work by M.F. Husain based on ‘The Last Supper’ was sold for USD 1.1 Million against the pre-sale estimate of USD 700,000. This currently remains the most expensive painting sold on our platform, and we are very pleased with the confidence reposed in us by our buyers that are reflective of our results.

Being the only auction house in the Middle East that has a regular calendar of ‘South Asian Art’ auctions, what trends have you observed with collectors of this genre of art?

Yes, that is absolutely correct, in fact, we are the UAE’s first home-grown auction house for art and luxury collectibles and the only auction house in the region conducting auctions of South Asian art. The buyer base for this genre of art is the South Asian diaspora in the region and other overseas countries, besides collectors from India. There is a definite growing interest amongst the community to collect works of established artists, buying art for them is a tangible experience which we offer in our Dubai based viewing gallery. Quality works by Modernists with impeccable provenance generates the maximum interest, with the aesthetically appealing subjects being the most preferred, as these collectors want to live with the works rather than store them as pure investments.

Given the recent implementation of VAT in the UAE, how will this affect your auctions and the art market in general?

VAT in the UAE has been set at a very low rate of 5% for all goods and services. As an auction house dealing in pre-owned art and collectibles we are obliged to charge the VAT only on our commission, which is fixed at 20% of the Winning Bid, hence the net impact to the buyer’s within UAE will be negligible at just 1% of the total purchase price, and overseas buyers will not be charged any VAT. We feel that the overall art market will also be able to absorb the impact of the 5% VAT between the galleries and buyers without affecting sales.

ARTIANA was featured in the latest South Asian Art Market report as one of the top auction houses amongst other older auction houses, how have you managed to achieve this in a short span of time?

Yes, we managed to garner close to 5% market share of South Asian art which merited our inclusion in the list of top auction houses focusing on this genre of art. Even though ARTIANA exists publicly in its current structure for the last three years, actually it is a convergence of my three decades of engagement and experience in the South Asian art sphere, which brought together my expert knowledge, relationships, network and credibility to form this successful platform. Another aspect that may have acted as a catalyst is our disruptive ‘No Buyer’s Premium’ policy, which results in savings ranging from 15%-40% for our buyers as compared to the final payable amounts over and above the ‘Winning Bid’ at other auction houses.

According to recent art trade reports, lack of transparency is the main stumbling block holding the online art market thus fewer people purchase art online, how will ARTIANA address this?

Even though we use an omnichannel marketing strategy, and maintain a brick and mortar gallery for hosting our auction previews, we conduct all our auctions online and believe that this is the way forward for transacting art, hence our commitment towards furthering our digital strategy is always foremost in our business objectives. The key requirement to make this successful is gaining the confidence of new buyers that land on our website and retention of buyers that have transacted on our platform. The majority of these buyers use our past auction results for reference, and we permanently archive these results including the unsold lots for their information to maintain transparency on the pricing and the result of every lot offered at our sales. Besides this, the prospective buyers are provided with provenance for every work after an in-depth investigation into its authenticity and ownership, and a comprehensive Artiana guarantee that covers all items sold on our platform for a period of six months from the auction closing date. These aspects add to our reliability and ensure the buyers that they are transacting with a premier dependable auction house.

Please share with us ARTIANA’s journey till now and what can we look forward to in terms of ARTIANA’s future plans and sales?

ARTIANA has launched three years ago and conducted its first auction in March 2016, maintaining a calendar of two South Asian Art auctions in a year. After our first year, we introduced classical art in our catalogues that featured Gandharan and Indian sculptures and Indian miniature and company paintings sourced from outside India and vetted by our leading experts, these items have found a lot of interest with collectors, especially those based outside India as these works are non-exportable from within India. In terms of overall sales, we grew three-fold between our first auction and our last concluded sale and have received positive feedback from our clients for our efforts in combining a curated catalogue with multiple entry levels and low impact costs. We plan to continue building similar catalogues for our upcoming sales every March and October which have become permanent fixtures in the South Asian art calendar. This year we are planning to launch sales of Rugs & Carpets, Prints & Multiples followed by Middle Eastern art in the near future.

(Originally published in Widewalls)

ARTIANA’s upcoming auction of Classical, Modern and Contemporary paintings and sculptures from the South Asian region will be held online on May 10-14 at www.artiana.com, with previews at their Downtown Dubai viewing gallery. The auction begins on May 10 at 6pm UAE time and will close on May 14 between 6:30-9pm. ARTIANA is UAE’s first home-grown auction house for art and luxury collectibles and has been receiving an overwhelming response from the art market, collectors and enthusiasts due to their efforts in bringing rare and authentic works of art to the market. Their last sale in October 2017 clocked sales over US$ 3 million with 96% lots being sold, 128% total sale value against the lower estimate, and MF Husain’s seminal work ‘The Last Supper’ being sold for US$ 1.1 million against a lower estimate of US$ 700,000.

Their May auction features seminal new-to-market works by MF Husain with ‘Trinity of Mother Teresa’ being the cover lot and another work of two horses painted on the day of the India and Sri Lanka Cricket World Cup final match depicting the two teams as stallions of the cricket world; including an important work ‘Thou Sayest So’ by Krishen Khanna, ‘Dhayan’ by SH Raza and an impressive bronze sculpture of Vishnu among other rare works by Bhupen Khakhar, Ram Kumar and SH Raza.

Future auctions are planned for art from the Middle East which will comprise works by Emirati artists including other surrounding countries and diaspora artists from this region, a sale of Rugs and Carpets which will offer a range of hand-woven Oriental rugs and carpets including textiles such as European paisley and Indian jamawar shawls, and a Prints and Multiples sale presenting prints by international artists executed in various printmaking techniques and three-dimensional multiples.

With its No Buyer’s Premium Policy, ARTIANA has redefined and streamlined the auction process offering clients the important elements of the traditional auction house services such as expertise, gallery viewings, and printed catalogues. Its USP slogan “What You Bid Is What You Pay”. Prospective buyers can view the works by prior appointment. Registration for the auction can be completed online at www.artiana.com or through their mobile app available on both Google Play for Android and the App Store for Apple devices. ARTIANA conducts the auction process online on www.artiana.com using its proprietary auction application software and distributes both online and physical catalogue for every auction. ARTIANA is founded by Lavesh Jagasia, an expert with three decades of experience in the sphere of Indian Art. He is a specialist in Modern and Contemporary South Asian Art and has collaborated with most of the leading South Asian artists on various projects.

Published: October 2017 – widewalls.ch

Among the words found in the vocabulary of the art market, we find “Buyer’s Premium”. In auctions, this is a percentage additional charge on the hammer price of a certain lot that must be paid by the buyer. All major auction houses implement it, usually between 10% and 30%, and it is charged as a remuneration in addition to, or instead of, seller’s commission. Buyer’s premium was there since the Roman ages, in particular during the reign of Augustus, and was introduced by Christie’s and Sotheby’s in 1975; and while Christie’s still implements it, Sotheby’s eliminated it in August 2017, following the steps of an auction house that had had it for years before that – ARTIANA.

This online platform for selling art was founded by Lavesh Jagasia, an expert on South Asian art with three decades of experience in the field and the founder of an art publishing firm The Serigraph Studio, which has collaborated with most of the leading South Asian artists. ARTIANA’s slogan was “What You Bid Is What You Pay”from the get-go, and naturally, it also applies to their upcoming South Asian Art Sale, taking place between October 26th and 30th. The No Buyer’s Premium policy was introduced in line with their commitment to keep the transactional costs for both buyers and sellers at a minimum – which could be part of the reason the idea might become widespread.

Of this, and more, we talked to Mr. Jagasia once again, so be sure to scroll down and have a read.

Widewalls: ARTIANA is known for the No Buyer’s Premium policy. What were the circumstances that brought you to this decision?

Lavesh Jagasia: ARTIANA was conceived as a hybrid auction house that would redefine and streamline the auction transaction process, and reduce the historically high costs associated with it, whilst still offering the important elements of the traditional auction house services such as expertise, viewings and printed catalogues desired by many art collectors.

I drew on my three decades of experience in the art sphere, both as a collector and an art entrepreneur to come with the most optimal offering without diluting any of the services expected from a premium auction house, simultaneously doing away with non-essential activities related to the actual sale.

A lot of buyers stay away from the art market due to the high costs of transacting art in the secondary art market, and there has been a decline in in-room bidding with buyers preferring to bid over the telephone or online, rendering the live bidding process, one of the main costs attached to the auction process as replaceable.

ARTIANA conducts the auction process online on its proprietary auction application software, while continuing to offer viewings at our own gallery, allowing us to pass on all the savings to our clients.

Convinced that the No Buyer’s Premium would grow the market and that this would be the new normal we pioneered this concept and coined our USP slogan ‘What You Bid Is What You Pay’.

Widewalls: What was the feedback of your buyers and sellers regarding the policy since you introduced it?

LJ: The buyers were extremely pleased with the No Buyer’s Premium policy resulting in our auctions being an immediate success. With the sellers, we had to explain that either way they are paying the entire commission both at the front-end and back-end just presented differently; in-fact this policy increased the possibility of attracting extra bids resulting in a better net realization for the seller.

Widewalls: It would seem that the idea is now being picked up by Sotheby’s and possibly by other auction houses in the future. How would you comment on these changes?

LJ: Yes, they have adopted the No Buyer’s Premium policy across all their online auctions. Traditional business models are regularly being challenged by disruptive business models and have to adapt accordingly. We are pleased to have spearheaded an important change in the way art will be transacted going forward.

Widewalls: If widely adopted, what would the sales without Buyer’s Premium bring to the art market in general? What will it mean for the artworks’ value?

LJ: The No Buyer’s Premium policy will widen the market by attracting new buyers, it would increase transaction activity and encourage investment in art. All this would result in an overall increase in the value of works of art that have secondary market demand.

Widewalls: The South Asian Art auction is approaching. What would you point out as its highlights?

LJ: Our South Asian Art sale is led by a seminal work by one of India’s important modernists MF Hussain. The painting is based on The Last Supper and presents a rare opportunity for any collector to acquire a significant work of this artist. The work is the pivotal feature of The Lost Continent series. Painted in July 2005 in London, the series gives an insight into Hussain’s sense of humanity and moral values. It was sold for USD 2 million in 2005 and, at the time, bore the record of the highest sum ever paid for a work of modern art from India.

The catalogue comprises paintings by artists such as FN Souza, Rameshwar Broota, Manjit Bawa among others including a collection of Indian classical paintings.

The sale features 60 lots of classical, modern and contemporary paintings, and will open for bidding from October 26, 2017, at 6:00 pm UAE time and will close on October 30 between 6:30 – 9:00 pm. Prior to the auction, buyers can view the works in our gallery by prior appointment. Registration for the auction can be completed on our website or through our mobile app available on both Google Play for Android and the App Store for Apple devices.

All images courtesy Artiana.

Source: widewalls.ch